Payment Channels

Payment channels enable high-frequency micropayments between API consumers and providers through off-chain payment commitments backed by on-chain escrow. This method is ideal for frequent API calls, allowing you to deposit tokens once into a smart contract and make multiple API requests with cryptographic signatures, eliminating gas fees for individual transactions.

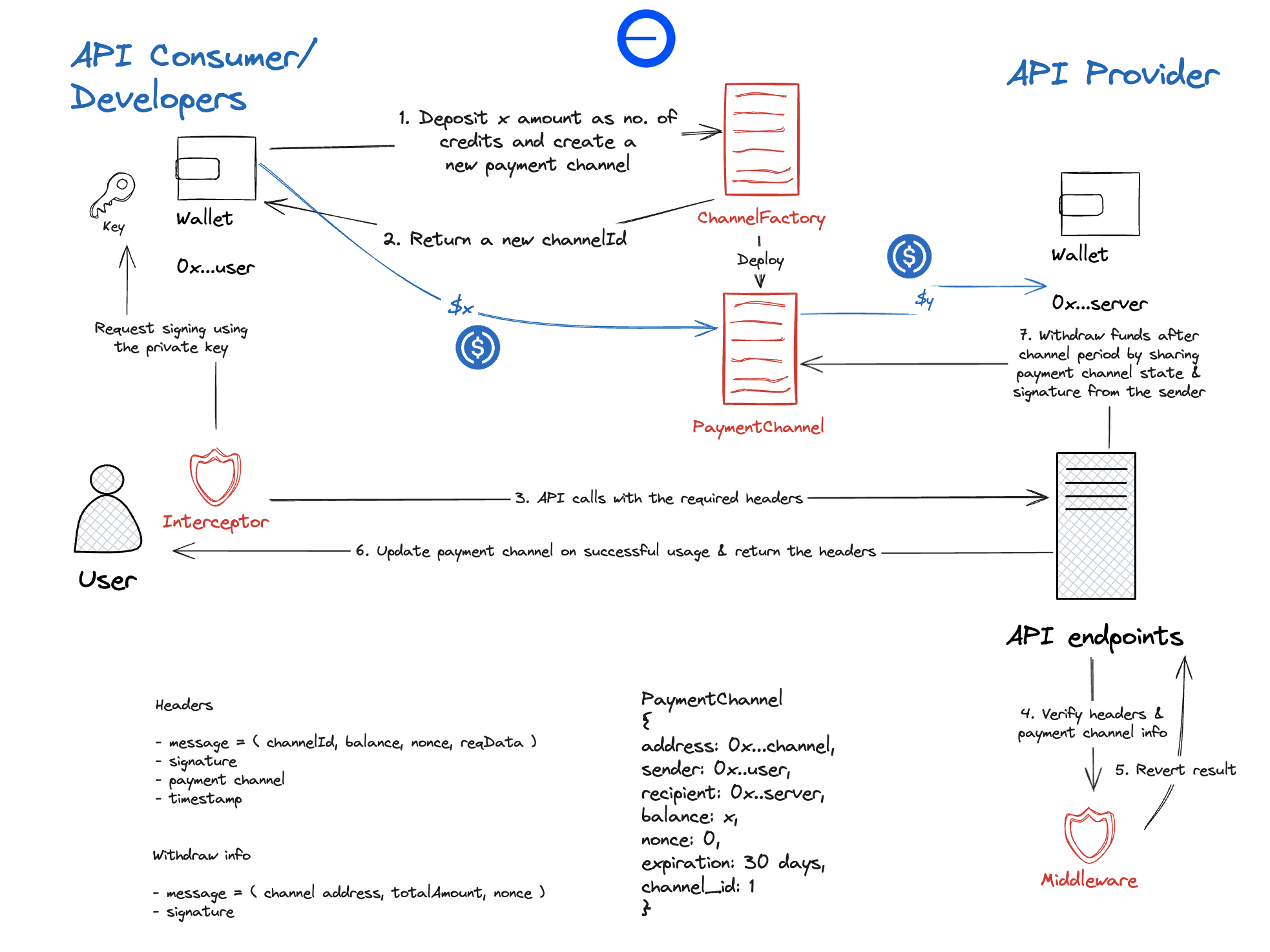

How Payment Channels Work

Users deposit tokens into a smart contract that acts as escrow between the consumer and API provider. Each API request includes a cryptographic signature that authorizes a small payment from this deposit. The provider can later settle multiple payments in a single on-chain transaction, making this extremely cost-effective for high-frequency usage.

Best Use Cases

- High-frequency API access: Make thousands of API calls without individual gas fees

- Micropayment workflows: Pay precise amounts per API request (e.g., $0.001 per call)

- Trusted recurring payments: Establish ongoing payment relationships with API providers

- Batch settlement: Settle multiple payments in a single on-chain transaction

How it works & Architecture

💡 Implementation Details

Channel Creation Flow

- Provider Registration: API provider registers their price per request in the `ChannelFactory. Optionally they can publish this on to a discovery service for easier client access.

- Channel Creation: Consumer calls

createChannel()with initial deposit and duration - Proxy Deployment: Factory deploys minimal proxy contract pointing to

PaymentChannelimplementation - Initialization: Channel contract initialized with consumer, provider, token, and pricing details

- Escrow Lock: Initial deposit transferred to channel contract as escrow

X-Payment Header Payload

Payment channels use the channel scheme with the x402 v1 format:

{

"x402Version": 1,

"network": "base",

"scheme": "channel",

"payload": {

"signature": "0x1234...",

"message": "0xabcd...",

"paymentChannel": {

"channelId": "1234567890",

"address": "0x...",

"sender": "0x...",

"recipient": "0x...",

"balance": "95.5",

"nonce": 42,

"expiration": 1672531200

},

"timestamp": 1672531200

}

}Key components:

- x402Version: Protocol version (1)

- network: Blockchain network (e.g., "base")

- scheme: Payment method ("channel")

- signature: Consumer's cryptographic authorization

- message: Hash of the signed data

- paymentChannel: Complete channel state information

- timestamp: When payment was created (5-minute validity window)

Verification Process

The middleware performs comprehensive verification in this order:

1. Header Validation

- Parse and validate X-Payment JSON structure

- Verify x402Version is 1 and scheme matches "channel"

- Check timestamp is within acceptable window (5 minutes)

2. Message Reconstruction & Signature Verification

- Reconstruct the signed message from channelId, balance, nonce, and request body

- Verify the message hash matches the submitted hash

- Recover signer address from signature and confirm it matches the channel sender

3. Channel State Validation

For existing channels:

- Verify nonce is greater than last processed nonce

- Calculate payment amount and validate against channel balance

- Ensure channel hasn't expired

For new channels:

- Query channel contract on-chain to validate existence and parameters

- Ensure nonce starts at 0 for first payment

4. State Update

- Update local channel state with new balance and nonce

- Store latest signature for potential on-chain settlement

State Management

Payment channels maintain state in two locations:

Server-Side State (In-Memory)

pub struct ChannelState {

channels: HashMap<U256, PaymentChannel>,

latest_signatures: HashMap<U256, PrimitiveSignature>,

}Critical Limitations:

- State lost on server restart or crash

- No persistent storage or recovery mechanism

- All pending channel balances reset to on-chain values

Client-Side State (In-Memory)

- Channel configuration and current balance

- Nonce tracking for replay protection

- Private key for signature generation

Recovery Mechanisms:

- Consumers can claim expired channel funds directly

- Providers can close channels and withdraw earned funds

- Unused credits refunded when channels are properly closed

Settlement Process

Payment channels support multiple settlement scenarios:

1. Provider-Initiated Closure

Providers can close channels and withdraw earned funds using the latest signature:

- Submit the most recent signature with final channel state

- Contract validates the signature and calculates earned amount

- Earned funds transferred to provider, remaining balance refunded to consumer

- Channel permanently closed

2. Timeout Claims

Consumers can recover funds from expired channels:

- Available after channel expiration timestamp passes

- Only works if provider hasn't closed the channel first

- Emergency recovery mechanism for unresponsive providers

Smart Contract Architecture

ChannelFactory Contract

- Purpose: Creates and manages payment channels using minimal proxy pattern

- Key Functions:

register(uint256 price): Provider sets price per requestcreateChannel(...): Deploy new payment channel proxy- Gas-optimized proxy deployment reduces channel creation costs

PaymentChannel Contract

- Purpose: Individual escrow contract for consumer-provider payments

- States: Uninitialized → Open → Closed

- Key Functions:

init(...): Initialize channel with parametersclose(...): Settle payments with signature verificationclaimTimeout(): Emergency fund recovery after expirationdeposit(uint256): Add funds to existing channel

Security Features

- Nonce-based replay protection: Prevents signature reuse

- Timestamp validation: Limits signature validity window

- State transition guards: Prevents unauthorized state changes

- Signature verification: Cryptographic proof of payment authorization

Network Integration

Payment channels currently support:

- Base Sepolia Testnet: Primary testing environment

- Token Support: Any ERC-20 token (USDC recommended)

- Factory Address:

0x5acfbe1f9B0183Ef7F2F8d8993d76f24B862092d

v0.6.0+ Unified Approach (Recommended)

For API Consumers

import { withPaymentInterceptor, ClientInterceptor } from "pipegate-sdk";

// Create channel (same process as before)

const pipeGate = new ClientInterceptor();

const channel = await pipeGate.createPaymentChannel({

recipient: "0x...",

duration: 2592000,

tokenAddress: "0x036CbD53842c5426634e7929541eC2318f3dCF7e",

amount: "100",

});

// Single unified interceptor with automatic state management

const client = withPaymentInterceptor(

axios.create({ baseURL: "https://api.example.com" }),

PRIVATE_KEY,

{ channel: channel }

);

// Automatic payment and state updates

const response = await client.get("/endpoint");For API Providers

use pipegate::middleware::{PaymentsLayer, PaymentsState, Scheme, SchemeConfig};

// Configure channel payments

let channel_config = SchemeConfig::new(

Scheme::PaymentChannels,

"https://base-sepolia-rpc.publicnode.com".to_string(), // Base Sepolia testnet

token_address, // USDC or other ERC-20 token address

recipient_address, // Provider's address to receive channel payments

"0.001".to_string(), // Price per API request in tokens

).await;

// Single middleware for all schemes

let app = Router::new()

.route("/api", get(handler))

.layer(PaymentsLayer::new(

PaymentsState::new(),

MiddlewareConfig::new(vec![channel_config])

));Legacy Implementation

For API Users

Create Payment Channel

import { ClientInterceptor } from "pipegate-sdk";

const pipeGate = new ClientInterceptor();

// Update these params with what you get from the API provider

const channelParams = {

recipient: "0x...", // API provider's address

duration: 2592000, // 30 days

tokenAddress: "0x036CbD53842c5426634e7929541eC2318f3dCF7e", // USDC

amount: "100", // 100 USDC

};

const channel = await pipeGate.createPaymentChannel(channelParams);

await pipeGate.addNewChannel(channel.channelId, channel);or If you want to use the cast CLI tool, refer to the steps here

Setup API Client

const api = axios.create({

baseURL: "https://api.example.com",

});

api.interceptors.request.use(

pipeGate.createPaymentChannelRequestInterceptor(channelId).request

);

api.interceptors.response.use(

pipeGate.createPaymentChannelResponseInterceptor().response

);Monitor Channel State

const channelState = pipeGate.getChannelState(channelId);

console.log("Balance:", channelState?.balance);

console.log("Expiration:", channelState?.expiration);For API Providers

Configure Middleware

use pipegate::middleware::payment_channel::{channel::ChannelState, types::PaymentChannelConfig};

use pipegate::utils::{Address, Url, U256};

let rpc_url: Url = "https://base-rpc.publicnode.com".parse().unwrap();

let state = ChannelState::new();

let config = PaymentChannelConfig {

recipient: Address::from_str("YOUR_ADDRESS").unwrap(),

token_address: Address::from_str("USDC_ADDRESS").unwrap(),

amount: U256::from(1000), // 0.001 USDC in this case

rpc_url: rpc_url.to_string(),

};Attach Middleware layer

use pipegate::middleware::payment_channel::{PaymentChannelMiddlewareLayer};

let app = Router::new()

.route("/", get(root))

.layer(PaymentChannelMiddlewareLayer::new(state, config));Register Price in Channel Factory

# Set your price per request (1000 = 0.001 USDC)

cast send $FACTORY_ADDRESS "register(uint256)" 1000 \

--rpc-url $RPC_URL \

--private-key $PRIVATE_KEYHandle Channel Closure

// Close channel and withdraw funds

let tx_hash = close_channel(

rpc_url,

private_key.as_str(),

&payment_channel,

&signature,

raw_body,

);or use CLI to close the channel

# Close the channel to withdraw 1 USDC with a nonce of 1000, along with the signature received during the API calls

# Factory Address: 0x5acfbe1f9B0183Ef7F2F8d8993d76f24B862092d

cast send $FACTORY_ADDRESS "close(uint256 channelBalance,uint256 nonce,bytes calldata rawBody,bytes calldata signature)" 1000 1000 0x0 $SIGNATURE \

--rpc-url $RPC_URL \

--private-key $PRIVATE_KEYExample for channel closure can be found here

Limitations & State Management

Server-Side Limitations

- State Loss on Restart: If the server restarts or goes down, all payment channel state is lost

- Transaction History: All pending transactions in the payment channel are instantly dropped when state is lost

- Recovery: No automatic recovery mechanism for lost state

Client-Side Limitations

- Interceptor Loss: If the client interceptor is dropped or application restarts, the payment channel cannot be reused temporarily

- Manual Recovery: Users need to wait for channel closure to recover unused funds

- Refund Process: Unused credits are refunded when the recipient closes the channel

Fund Recovery Options

For Recipients (API Providers)

Use the new close_and_withdraw_from_state function for automatic withdrawal:

use pipegate::middleware::payment_channel::channel::close_channel_from_state;

// Automatically close channel and withdraw funds from current state

let tx_hash = close_channel_from_state(

&channel_state,

rpc_url,

private_key.as_str(),

channel_id,

raw_body,

);For Users (API Consumers)

- Active Channel: Wait for recipient to close the channel to receive refund of unused credits

- Expired Channel: Claim funds directly if the channel has expired and hasn't been closed by the recipient

# Claim expired channel funds (call directly on the channel contract)

cast send $CHANNEL_ADDRESS "claimTimeout()" \

--rpc-url $RPC_URL \

--private-key $PRIVATE_KEYBest Practices

- Always monitor channel balance

- Set appropriate channel duration

- Handle channel expiration gracefully

- Implement proper error handling

- Plan for state loss: Consider implementing state persistence mechanisms

- Monitor server uptime: Ensure reliable server operation to maintain channel state

- Educate users: Inform API consumers about potential state loss scenarios